This sub-fund’s strategy is geared towards capital growth. It is mainly invested in French equities and a selection of international companies with a sound financial footing and excellent earnings power. The sub-fund is listed in euro and the recommended investment period is five years.

The fund invests directly in securities listed on official, recognised stock markets open to the public. Portfolio design is based on an in-depth analysis of macroeconomic factors (currencies, commodities, geographical regions, etc.) and the profiles of companies offering a strong growth outlook.

Objective and philosophy

The fund manager places the emphasis on blue chips, known for their quality, security and earnings power. This sub-fund aims to deliver reasonably high performance within the constraint of a cautious policy designed to protect invested capital.The fund follows the fund manager’s objective convictions:

- drawing on those economic sectors and geographical regions that appear ultimately to offer the best outlook in terms of growth or security

- not using any speculative leverage

- not investing in other funds, thus ensuring that investors can be aware of the exact composition of their investment

- The investment policy is based on the principles of prudence, stability and balance.

Laurent Billod

Investment adviser

Flexibility and precision

The fund mainly consists of French equities and international bonds (denominated in EUR, CHF, USD, etc.) issued by companies with a sound financial footing and excellent earnings power:

Investing in equities contributes to economic growth and expansion: it is a form of investment that has much to offer to savers who know they can preserve their savings by investing them long-term in equities.

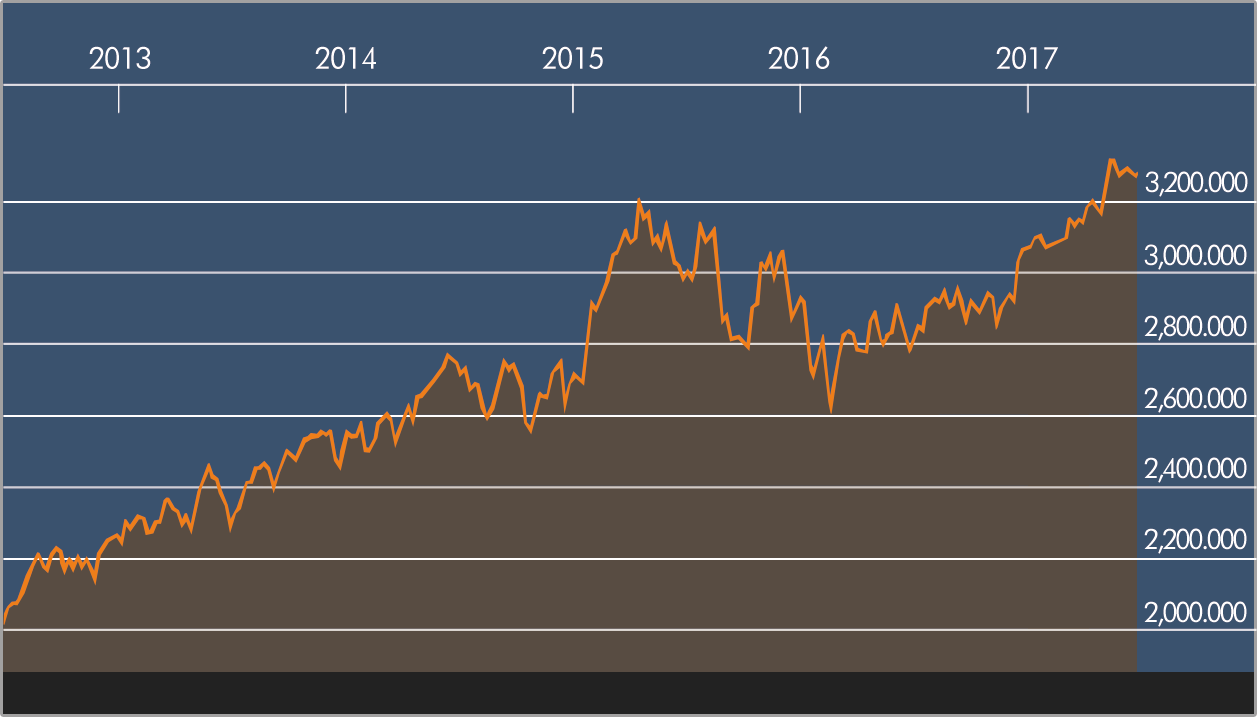

Source: AMF/Thomson Reuters research: base 100 = January 2013

Revenue growth, profitability, etc… As well as focusing on economic and financial performance, the fund manager also closely observes market behaviour.

Risks

- Equity risk: the fund’s net asset value can fall if equity markets decline.

- Foreign exchange risk: arises from exposure to a currency other than the fund’s currency of valuation.

- Credit risk: risk of loss of value as a result of issuer insolvency.

- Interest rate risk: risk of a fall in net asset value as a result of interest rate movements.

- This fund does not offer any capital guarantee.

Advantages

- Conviction-based investment: independent and transparent

- Freedom to choose the currency of investment and redemption (EUR, JYP, USD, etc.)

- Option of investing through a life insurance policy (European passport)

- High liquidity (one month maximum for all fund assets)

- No speculative leverage (warrants/swaps)

- Transparency of assets

- Non-benchmarked fund

Key characteristics

| Cosmos-Lux International Diversified | |

| ISIN Code | LU0090272112 |

| Valuation | Weekly |

| Website | www.cosmos-lux.com |

| Fees | Management (fixed) : 1,5% Subscription (max.) : 4% Redemption : 0% |

| Prospectus | Available on request from the investment adviser |

| Sub-fund currency | EUR |

| Appropriation of income | Capital growth |

| Eligible investors | All investors |

Recommended investment period

Overall risk

Did you know ?

Since the subprime crisis and the Madoff affair, the question of toxic assets has arisen in day-to-day fund management. From a safety perspective, it is prudent not to invest in a fund whose composition is unknown (e.g. funds of funds, now offered by many banks). To ensure long-term viability, all of our investments are direct investments in known securities and large caps, thus ensuring complete transparency for our investors.

Disclaimer

UCITS are products that entail a relatively high level of risk to your capital. You are advised only to invest funds that you could afford to lose. Investing in the financial markets may not be suitable for all investors, so it is important to be sure that you understand the risks incurred. A full description of the fund can be found in the prospectus, which you are advised to read. The contents of this document are provided purely for information and in no way constitute contractual or legal information. Past performance is not a reliable indicator of future performance. The fund does not offer any capital guarantee.