Listed in Swiss francs, this sub-fund selects equities and bonds mainly in the Swiss market. It uses a discretionary investment approach favouring diversification and safe haven investing. The investment period is five years.

Why Switzerland ?

Switzerland’s geographical position is strategic: the country is an open door to the European, African and Middle Eastern markets. Switzerland has world-class infrastructure as well as a legal and regulatory environment that is attractive to companies. The Swiss market is a good proving ground for introducing hi-tech and high-end products. Switzerland has a highly qualified and educated, trustworthy and relatively flexible workforce. Switzerland spends more on IT per capita than any other country in the world. It is also one of the most advanced countries in terms of research and development.

- he investment policy is based on the principles of prudence, stability and balance.

Laurent Billod

Investment adviser

Companies listed on the Swiss market

As a rule, Swiss companies offer a balanced geographical presence, innovative products and strong brands. The Swiss market is home to many companies with high growth potential, a high level of international diversification and leading positions in their sectors. To enable investors to take advantage of these benefits, this fund is mainly invested in Swiss securities, selected on the basis of fundamental and totally opportunistic analysis. The portfolio is concentrated around the fund manager’s strongest convictions.

Investment rules: flexibility and thoroughness

This sub-fund seeks out investments positioned for the long haul in equities and bonds, mainly in Swiss francs, in keeping with the fund manager’s objective convictions:

- drawing on those economic sectors and geographical regions that appear ultimately to offer the best outlook in terms of growth and security

- not using any speculative leverage

- not investing in other funds, thus ensuring that investors can be aware of the exact composition of their investment

What are the risks and advantages of this asset?

Risks

- Conviction-based investment: independent and transparent

- Freedom to choose the currency of investment and redemption (EUR, JYP, USD, etc.)

- Option of investing through a life insurance policy (European passport)

- High liquidity (one month maximum for all fund assets)

- No speculative leverage (warrants/swaps)

- Transparency of assets

- Non-benchmarked funds

Advantages

- Conviction-based investment: independent and transparent

- Freedom to choose the currency of investment and redemption (EUR, JPY, USD, etc.)

- Option of investing through a life insurance policy (European passport)

- High liquidity (one month maximum for all fund assets)

- No speculative leverage (warrants/swaps)

- Transparency of assets

- Non-benchmarked funds

Key characteristics

| Cosmos-Lux Swiss Franc | |

| ISIN Code | LU0989373237 |

| Valuation | Weekly |

| Website | www.cosmos-lux.com |

| Fees | Management (fixed) : 1,5% Subscription (max.) : 4% Redemption : 0% |

| Prospectus | Available on request from the investment adviser |

| Sub-fund currency | CHF |

| Appropriation of income | Capital growth |

| Eligible investors | All investors |

Recommended investment period

Overall risk

Did you know?

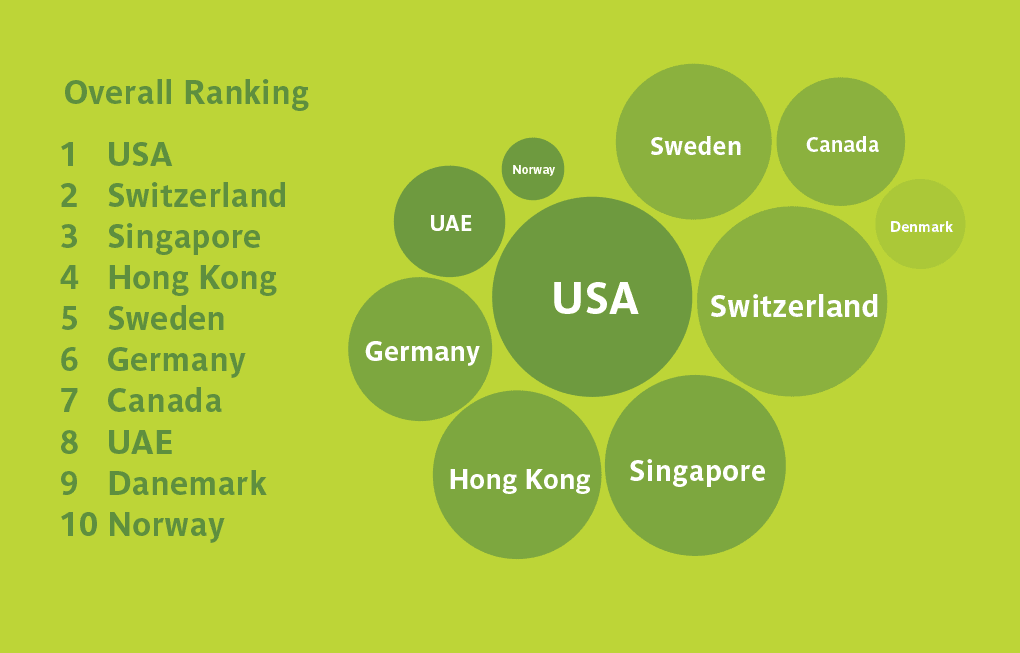

While the majority of the most competitive countries are playing musical chairs, gaining or losing a place each year, Switzerland has held onto its number two position in the IMD (International Institute for Management Development) ranking, just behind the United States and ahead of Singapore. Switzerland has a number of strengths, including quality of life and economic resilience, on both of which the country tops the rankings, and companies’ ability to adapt to market conditions, as well as social cohesion (second place), diversification and effective management of public finances (fifth place). For opinion leaders, the workforce remains highly motivated, with significant international experience and a high-performing dual education system. Switzerland has retained its image as an innovative and highly competitive country where it is easy to do business.

Disclaimer

UCITS are products that entail a relatively high level of risk to your capital. You are advised only to invest funds that you could afford to lose. Investing in the financial markets may not be suitable for all investors, so it is important to be sure that you understand the risks incurred. A full description of the fund can be found in the prospectus, which you are advised to read. The contents of this document are provided purely for information and in no way constitute contractual or legal information. Past performance is not a reliable indicator of future performance. The fund does not offer any capital guarantee.